Closing Costs For California Real Estate . The state’s median home sale. Find out more closing costs in california and what buyers and sellers pay for. Transfer tax varies by city. in california, sellers can expect to pay about 5.7% in closing costs, which includes realtor fees. All of the closing costs above are. In california, closing costs are well above the national average. Without realtor costs, sellers can pay about 0.08% of the sale price. closing costs in california typically average around 2.5% of the home's sale price for the buyer and around 7.5% for the seller. closing costs are the taxes and fees associated with the purchase and sale of a home, such as title insurance and. in california, excluding realtor’s fees, these costs amount to about 1 percent of a home’s sale price, per closingcorp. = old republic title ofice located = additional city transfer tax information. California has some of the highest closing costs in.

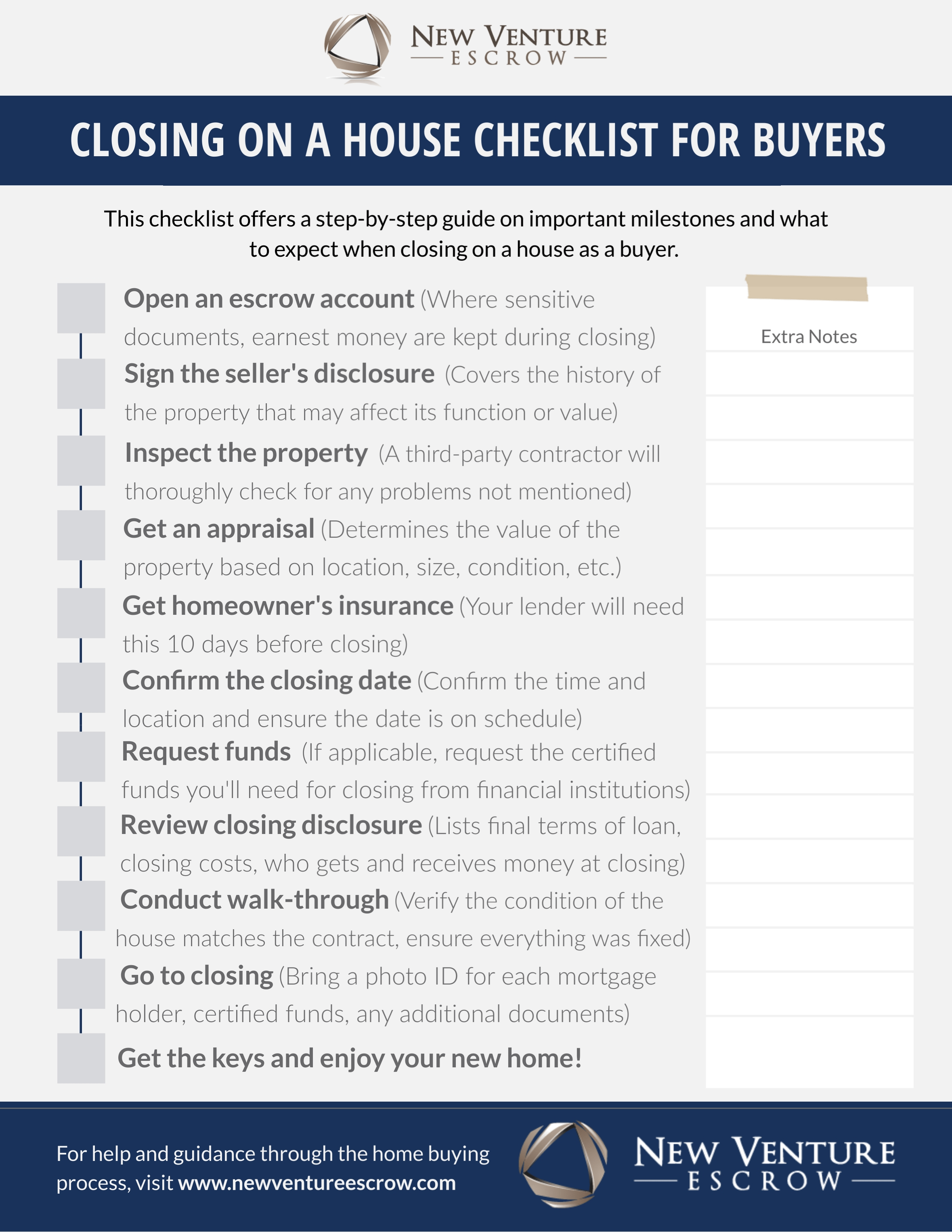

from newventureescrow.com

= old republic title ofice located = additional city transfer tax information. Transfer tax varies by city. in california, sellers can expect to pay about 5.7% in closing costs, which includes realtor fees. Without realtor costs, sellers can pay about 0.08% of the sale price. Find out more closing costs in california and what buyers and sellers pay for. California has some of the highest closing costs in. All of the closing costs above are. In california, closing costs are well above the national average. closing costs in california typically average around 2.5% of the home's sale price for the buyer and around 7.5% for the seller. in california, excluding realtor’s fees, these costs amount to about 1 percent of a home’s sale price, per closingcorp.

Closing on a House Checklist for Buyers in California StepbyStep and

Closing Costs For California Real Estate closing costs are the taxes and fees associated with the purchase and sale of a home, such as title insurance and. California has some of the highest closing costs in. Without realtor costs, sellers can pay about 0.08% of the sale price. closing costs are the taxes and fees associated with the purchase and sale of a home, such as title insurance and. in california, excluding realtor’s fees, these costs amount to about 1 percent of a home’s sale price, per closingcorp. Find out more closing costs in california and what buyers and sellers pay for. closing costs in california typically average around 2.5% of the home's sale price for the buyer and around 7.5% for the seller. = old republic title ofice located = additional city transfer tax information. The state’s median home sale. In california, closing costs are well above the national average. Transfer tax varies by city. All of the closing costs above are. in california, sellers can expect to pay about 5.7% in closing costs, which includes realtor fees.

From realtyna.com

What Are Closing Costs in Real Estate? Closing Costs For California Real Estate All of the closing costs above are. Find out more closing costs in california and what buyers and sellers pay for. in california, sellers can expect to pay about 5.7% in closing costs, which includes realtor fees. Transfer tax varies by city. The state’s median home sale. In california, closing costs are well above the national average. closing. Closing Costs For California Real Estate.

From www.soldnest.com

How Much Are Seller Closing Costs in California? Closing Costs For California Real Estate in california, sellers can expect to pay about 5.7% in closing costs, which includes realtor fees. closing costs are the taxes and fees associated with the purchase and sale of a home, such as title insurance and. All of the closing costs above are. California has some of the highest closing costs in. In california, closing costs are. Closing Costs For California Real Estate.

From www.realestateskills.com

Closing Costs In California Who Pays & How Much? Closing Costs For California Real Estate = old republic title ofice located = additional city transfer tax information. in california, sellers can expect to pay about 5.7% in closing costs, which includes realtor fees. closing costs are the taxes and fees associated with the purchase and sale of a home, such as title insurance and. All of the closing costs above are. Without realtor. Closing Costs For California Real Estate.

From old.sermitsiaq.ag

Real Estate Closing Statement Template Closing Costs For California Real Estate in california, excluding realtor’s fees, these costs amount to about 1 percent of a home’s sale price, per closingcorp. closing costs are the taxes and fees associated with the purchase and sale of a home, such as title insurance and. California has some of the highest closing costs in. All of the closing costs above are. closing. Closing Costs For California Real Estate.

From www.etsy.com

Real Estate Closing Checklist Closing Costs Chart for Buyers Etsy Closing Costs For California Real Estate closing costs are the taxes and fees associated with the purchase and sale of a home, such as title insurance and. Without realtor costs, sellers can pay about 0.08% of the sale price. = old republic title ofice located = additional city transfer tax information. in california, excluding realtor’s fees, these costs amount to about 1 percent of. Closing Costs For California Real Estate.

From bigblockrealty.com

What Are Real Estate Closing Costs? (In California) Big Block Realty Closing Costs For California Real Estate Without realtor costs, sellers can pay about 0.08% of the sale price. in california, sellers can expect to pay about 5.7% in closing costs, which includes realtor fees. The state’s median home sale. closing costs in california typically average around 2.5% of the home's sale price for the buyer and around 7.5% for the seller. in california,. Closing Costs For California Real Estate.

From www.bankrate.com

How Much Are Closing Costs In California Who Pays For What? Closing Costs For California Real Estate The state’s median home sale. Transfer tax varies by city. All of the closing costs above are. in california, sellers can expect to pay about 5.7% in closing costs, which includes realtor fees. In california, closing costs are well above the national average. closing costs in california typically average around 2.5% of the home's sale price for the. Closing Costs For California Real Estate.

From legacysfhomes.com

2023 California Closing Costs Guide Free Download for Home Buyers and Closing Costs For California Real Estate The state’s median home sale. Without realtor costs, sellers can pay about 0.08% of the sale price. in california, sellers can expect to pay about 5.7% in closing costs, which includes realtor fees. All of the closing costs above are. Find out more closing costs in california and what buyers and sellers pay for. In california, closing costs are. Closing Costs For California Real Estate.

From www.pinterest.com

Customary Closing Costs in Northern California CaliLiving Closing Costs For California Real Estate Transfer tax varies by city. Without realtor costs, sellers can pay about 0.08% of the sale price. The state’s median home sale. All of the closing costs above are. closing costs in california typically average around 2.5% of the home's sale price for the buyer and around 7.5% for the seller. = old republic title ofice located = additional. Closing Costs For California Real Estate.

From www.soldnest.com

How Much Are Seller Closing Costs in California? Closing Costs For California Real Estate The state’s median home sale. closing costs are the taxes and fees associated with the purchase and sale of a home, such as title insurance and. Without realtor costs, sellers can pay about 0.08% of the sale price. California has some of the highest closing costs in. in california, excluding realtor’s fees, these costs amount to about 1. Closing Costs For California Real Estate.

From issuu.com

California Customary Closing Costs and Transfer Tax (Updated 01/12/2023 Closing Costs For California Real Estate closing costs in california typically average around 2.5% of the home's sale price for the buyer and around 7.5% for the seller. in california, sellers can expect to pay about 5.7% in closing costs, which includes realtor fees. The state’s median home sale. = old republic title ofice located = additional city transfer tax information. Find out more. Closing Costs For California Real Estate.

From www.realestateskills.com

Closing Costs In California Who Pays & How Much? Closing Costs For California Real Estate California has some of the highest closing costs in. in california, excluding realtor’s fees, these costs amount to about 1 percent of a home’s sale price, per closingcorp. = old republic title ofice located = additional city transfer tax information. closing costs in california typically average around 2.5% of the home's sale price for the buyer and around. Closing Costs For California Real Estate.

From assurancemortgage.com

How to Estimate Closing Costs Assurance Financial Closing Costs For California Real Estate in california, excluding realtor’s fees, these costs amount to about 1 percent of a home’s sale price, per closingcorp. In california, closing costs are well above the national average. Without realtor costs, sellers can pay about 0.08% of the sale price. Find out more closing costs in california and what buyers and sellers pay for. All of the closing. Closing Costs For California Real Estate.

From jacksonfuller.com

The Estimated Settlement Statement Jackson Fuller Real Estate Closing Costs For California Real Estate Transfer tax varies by city. The state’s median home sale. Find out more closing costs in california and what buyers and sellers pay for. closing costs in california typically average around 2.5% of the home's sale price for the buyer and around 7.5% for the seller. in california, excluding realtor’s fees, these costs amount to about 1 percent. Closing Costs For California Real Estate.

From www.bahia.ba

What Is Included In Closing Costs For Buyer BAHIA HAHA Closing Costs For California Real Estate California has some of the highest closing costs in. Transfer tax varies by city. in california, excluding realtor’s fees, these costs amount to about 1 percent of a home’s sale price, per closingcorp. in california, sellers can expect to pay about 5.7% in closing costs, which includes realtor fees. = old republic title ofice located = additional city. Closing Costs For California Real Estate.

From kimberleequarlesrealestate.blogspot.com

San Diego Real Estate, Kimberlee Quarles Realtor Buyer Closing Costs Closing Costs For California Real Estate Without realtor costs, sellers can pay about 0.08% of the sale price. in california, sellers can expect to pay about 5.7% in closing costs, which includes realtor fees. All of the closing costs above are. in california, excluding realtor’s fees, these costs amount to about 1 percent of a home’s sale price, per closingcorp. California has some of. Closing Costs For California Real Estate.

From www.edmontonrealestate.ca

What Closing Costs Do Home Buyers Pay? Closing Costs For California Real Estate The state’s median home sale. in california, excluding realtor’s fees, these costs amount to about 1 percent of a home’s sale price, per closingcorp. California has some of the highest closing costs in. closing costs in california typically average around 2.5% of the home's sale price for the buyer and around 7.5% for the seller. in california,. Closing Costs For California Real Estate.

From lands.wineowine.com

Closing Checklist Template Closing Costs For California Real Estate in california, excluding realtor’s fees, these costs amount to about 1 percent of a home’s sale price, per closingcorp. = old republic title ofice located = additional city transfer tax information. in california, sellers can expect to pay about 5.7% in closing costs, which includes realtor fees. Transfer tax varies by city. closing costs are the taxes. Closing Costs For California Real Estate.